Plus other highlights from the first quarter call

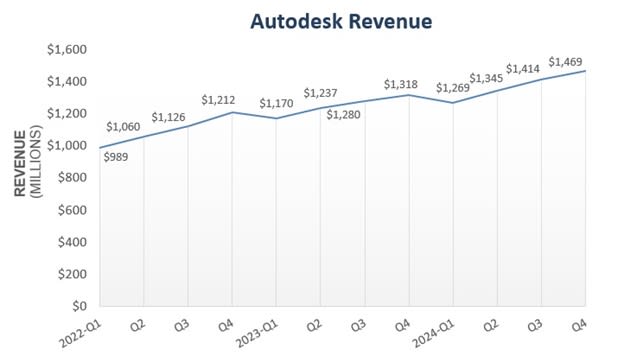

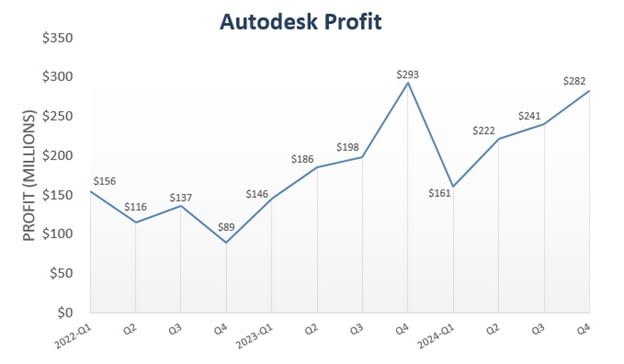

Autodesk continues its torrid pace for Q4 of its 2024 fiscal year, giving the company four straight quarters of revenue growth and three quarters of profit climbing at an even more rapid rate, now near an all-time high.

Autodesk, in third place of the Big Four, keeps pace with second-place Dassault Systèmes, which posted a 15% revenue increase, and distances itself from PTC, which recorded a revenue drop in the last quarter.

It starts with AI

Just as in every conference and analyst meeting of late, Autodesk is quick to bring up AI.

“Autodesk is getting closer to a transformational leap in using generative AI to design the way ChatGPT has used language to get text answers,” said Andrew Anagnost, CEO of Autodesk.

But how?

“Our new multimodal foundation models will enable Design and Make* customers to automate low-value and repetitive tasks and generate more high-value complex designs more rapidly and with much greater consistency,” said Anagnost. “We can already generate 3D representations from images 10 times faster, with higher-quality, and currently available through the AI. We’re bolstering our homegrown capabilities and data with partnerships and acquisitions in existing and adjacent verticals.”

What a difference since the beginning of the fiscal year when Anagnost said Autodesk would be doing “neither a course correction nor a speed change” for AI, which at that time was blowing up because of ChatGPT.

Now, the plan is to use AI throughout Autodesk apps, whether to automate and aid grunt workflows, such as dimension drawing creation, or to disrupt them — albeit in a good way.

“We have to do both,” said Anagnost.

Financial calls are normally tightrope walks between promising too much and too little. Hardly ever are they pre-announcement of future products. But here was Anagnost promising solid models from photographs.

Autodesk will have new tools for generating 3D models from photographs or incomplete 3D models, he said.

The company considers itself involved with AI for ten years, retro-classifying generative design (based on topology optimization) as AI.

“We are leaders in generative design,” said Anagnost. “And now we are leading in generative AI.”

Furthermore, Autodesk will be piping savings from recent efficiencies achieved into what are turning out to be the company’s two main technology initiatives: cloud products (Autodesk’s industry clouds) and AI.

Other highlights

Autodesk reported on its transition to direct sales, which it tested in Australia. Since the beginning, Autodesk has been selling to resellers who, in turn, sell to end-users, similar to auto companies that sell to dealers who sell to drivers. It seems the transition to selling directly to users has accelerated.

Autodesk sees the $600 million of discounts given to resellers as contra income that it could have kept for itself. This has been a near-riot with resellers, to whom the discount is a margin and primary source of revenue. Autodesk’s attitude borders on “let them eat cake.” Autodesk insists that resellers are still important, but the company must go forward with value-added services, such as training, consulting, and customizations.

The direct sales model rolls out next quarter in North America, every software vendor’s most lucrative market. So, we might see that riot mentioned previously. Anagnost cautioned analysts about upcoming noise in P&L (profit and loss) and requested they look at free cash flow as a better indication of financial health.

AutoCAD, the product that made Autodesk famous but lately resigned to the role of faithful spouse while others get the jewels, is not only hanging on, it is thriving. AutoCAD and AutoCAD LT sales rose 7% this quarter. Architecture, Engineering, and Construction (AEC) product revenue made the biggest leap, growing by 18%, while Manufacturing grew by 16%.

The U.S. continues to be Autodesk’s top market. Revenue for North and South America was the highest in the world, with 9% growth.

Billings declined 19% — nothing to worry about, we were assured. That was merely a result of customers shifting from annual upfront contracts to multi-year contracts, opening a gap that will close in short order.

These customers got shout-outs:

- VINCI, a French construction firm specializing in transportation and energy projects.

- Fortis Construction, an Oregon-based firm that ran Autodesk Construction Cloud through a six-month pilot program before signing up for a multi-year contract for multiple Autodesk products.

- Pennsylvania Department of Transportation (PennDOT) which chose Autodesk Construction Cloud (ACC). This is remarkable since archrival Bentley Systems has a near lock on DOTs nationwide. However, PennDOT must retain many of Bentley’s products, as ACC was chosen as it is an “open ecosystem” and inclusive of other software.

On the Manufacturing side, the company said its users in automotive studios (Alias users) are drifting towards Autodesk applications as design travels downstream (into Fusion?). No names of design studios were provided.

Another leading manufacturer achieved a crossover using Fusion and turned to Autodesk AEC applications (notably ACC) during a smart factory design to see the operating factory in virtual reality before it is built.

Another unnamed large manufacturer was using Fusion and Autodesk’s CAM (PowerMill) and plastics simulation (Moldflow) applications and is planning to add Revit and ACC. The company signed up for Autodesk’s EBA (Enterprise Business Agreement), which, with its all-the-toppings approach to software, might as well stand for Everything But Anchovies.

Anagnost called Fusion the fastest-growing MCAD software, having reached 255,000 subscribers. Are these paying subscribers, though? Or did they include schools such as the University of Delaware, which offers Fusion to 600 students?

Autodesk projected a net growth in revenue for the fiscal year of $5.99 billion (up 9%) to $6.09 billion (up 11%) from FY2024.

The not-so-reluctant CEO

It is another successful quarter for Autodesk, further cementing Anagnost’s role as a well-rounded CEO. Listening to him for the first time on a financial call, one might be surprised to learn he has a Ph.D. in aerospace engineering and computer science from Stanford. Those who have watched his ascension at Autodesk may be surprised he hasn’t introduced more technology of value for aerospace design. Anagnost has been more creative with business initiatives than new products. For the last few years, the foremost initiative has been applying technology and processes well used in manufacturing into AEC. And even more recently, he has been all about AI. Who can blame him?

Anagnost has made Autodesk a good investment. The company’s stock price is currently more than double what it was when he became CEO in 2017 and is now climbing back to its $300-plus glory days.

_____________________

*The Design business includes desktop products such as AutoCAD, Inventor and Revit. Make products are cloud based, such as Fusion 360.