The first step is digitalization in the CPG industry.

Siemens Digital Industries has sponsored this post. Written by Mario Vollbracht, VP of Consumer Products and Retail, Siemens Digital Industries Software.

Globalized and highly competitive, the consumer packaged goods (CPG) industry has remained eternally resilient. However, emerging trends are set to significantly impact demand and potentially open new revenue streams. Shifts in consumer preferences, increased competition from the lowering of entry barriers, and a growing population worldwide have transformed the markets. Meanwhile, retailers have created their own formidable brands with private label product lines, which has forced brand manufacturers to adjust their prices, putting even more strain on their profit margins.

CPG companies are confronting these competitive concerns while simultaneously seeking to improve profit margins, meet regulations and satisfy consumer demands for greater levels of sustainability and transparency across the entire product lifecycle.

To address this multitude of elaborate challenges and the ever-changing landscape of the CPG industry requires an evolution of processes and technologies. This is why top performers in the industry have begun digitalizing their operations. Digital transformation is an important way to support growth, become more efficient and guarantee resilience as competition increases and consumers evolve.

Shifting consumer demands

Consumer desires have never been consistent, but today there are many interesting factors affecting these demands, which have increased market fragmentation and caused the proliferation of new brands and SKUs (stock keeping units), so it is important to understand them.

One factor is that CPG companies are now targeting the Generation Z (Gen Z) market segment. Studies indicate that about 38 percent of Gen Z is willing to try new brands and buy healthier as well as more sustainable, transparent and innovative products from multiple companies. This is an increase compared to other generations.

Other factors include the acceleration of online buying and initiatives like “eat at home,” which gained considerable momentum during COVID. These factors are forcing companies to redesign their product portfolios. According to a new report from Grand View Research, the meal kit industry in the United States could achieve a compound annual growth rate of 15.3 percent, reaching nearly $64 billion by 2030. Online platform meal kit sales currently account for over 63 percent of this market.

One of the biggest factors affecting consumer demands is that the UN predicts the worldwide population will reach 8.6 billion by 2030 — with most of this growth driven by developing and emerging markets. Consequentially, many of these consumers will have limited disposable income as World Bank studies estimate that 47 percent of the global population lives on less than $6.85 USD per person per day.

Managing these factors will require CPG companies to accelerate their speed to market and be more responsive to consumer demands while guaranteeing shorter and increased NPI (new product introduction) cycles. To accomplish this, companies must digitally integrate the entire lifecycle to break down department silos and allow information and data to flow to all necessary stakeholders. This requires more than the adoption of a few digital tools or just digitalizing certain aspects of the process. Digitalization of the entire product development process is critical to success.

Flexible factories for flexible production

The changing landscape of innovation, personalized products, accelerated e-commerce and trade shifts are also putting extreme pressures on factories and their manufacturing operations. CPG is a highly automated industry so it would seem well positioned to meet the changing landscape. However, most CPG companies implemented their automation systems between the 1980s and 1990s. Their main goal at that time was to produce large product batches as efficiently as possible. Forty years later, these same machines and automation systems have difficulty adapting to continuous product changes. This is partly because they are not equipped with modern technologies that aid connectivity and flexibility, such as IoT and AI.

Today, factories need to be able to manufacture a greater number of products and product variants. When a newly updated product recipe reaches the factory, businesses need to be able to quickly and easily update and/or reconfigure the entire manufacturing process — from line automation to machines. Manufacturers need production systems and machines that can guarantee speed and quality as well as flexibility so they can quickly adapt to market changes. Whether a company is building a new factory or converting existing factories, introducing flexibility in the manufacturing ecosystem is key.

There are several ways to increase production flexibility. Leveraging digital twin technology — combined with manufacturing planning and manufacturing operations solutions — early in the product lifecycle, enables companies to predict production feasibility and performance while minimizing downtimes and ensuring quality. One of the latest advances in the automation area is the use of virtual programmable logic controllers (PLCs). Organizations can download virtual PLCs as edge applications and integrate them directly into the IT environment, modernizing older factories or manufacturing lines.

Lines and manufacturing equipment also play significant roles in improving production flexibility. New intelligent machines often have flexible, modular designs that facilitate integration into production lines and can adapt to perform several tasks. These new technologies are applied to these machines via edge computing where they can run software at the machine level — including AI applications. IoT enabled machines can increase connectivity, easing integration and can even automate some engineering tasks.

Navigating the complexities of the supply chain

Supply chain risks remain an ever-present issue for CPG. Oil price fluctuation, political crises and wars negatively impact traditional supply routes, forcing companies to strategically analyze their product portfolios, look for alternates and evaluate new supply options. Often, businesses opt to nearshore, or manufacture close to the consumer to shorten the supply chains.

Additionally, obstacles can arise from weather and other climate-related occurrences which can hinder improving profit margins. Digitalizing the supply chain to build a “central control tower” can address these challenges. Flexible supply chain planning solutions facilitate real-time information on shipping costs, tariffs and materials, enabling better informed decisions.

Digital control towers, however, only solve part of the supply chain challenge. Contamination, for example, is a growing concern in the food and beverage industry, and is often caused by faults in the supply chain. CPG safety is also becoming increasingly important as stringent country and region-based regulations influence practices. Even still, food poisoning incidents are rising with an estimated one in 10 people falling ill from eating contaminated food globally every year. Many cases of food poisoning are caused by supply chain hiccups, with agricultural ingredients and final food products being the most susceptible.

Whether CPG companies source materials locally or overseas, the risk of interferences in the supply chain will always exist. Traceability of both ingredients and final products is the only way to certify that products are safe and legitimate. In the event there is an issue of contamination, traceability makes it possible to quickly determine the source.

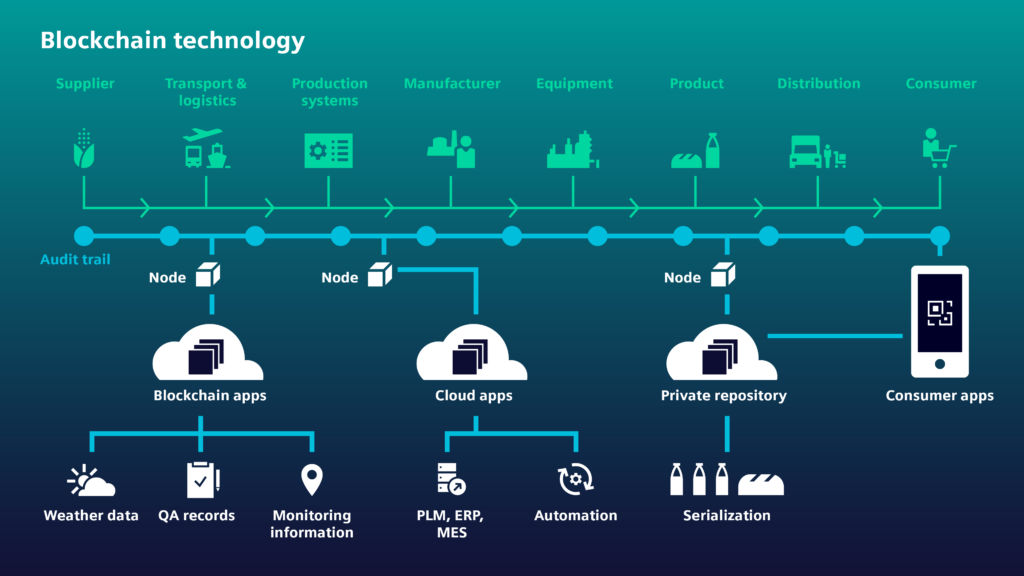

The integrated lifecycle management solutions available today make it possible to develop a robust digital backbone, which can provide full traceability of products. Blockchain technology, for example, immutably stores traceability and event data, providing stakeholders with a single source of truth generated from secure data that cannot be overwritten or changed. This creates a digital footprint for the verification and validation of information. Coupled with IoT, blockchain technology can provide insights “from farm to fork,” helping to eradicate human error and enhancing transparency in a complex and multi-tiered supply chain.

Preparing for tomorrow’s problems today

Many companies in the CPG industry are reluctant to enhance and digitalize their processes through software and automation. The industry fears that implementing new technology may impact downtimes and increase operational costs. While the idea of continuing to “do things the way they have always been done” appears safe, it is not. The current landscape requires a revolution in the way companies develop, manufacture and source their products.

The CPG industry needs to implement fresh, flexible and scalable digital solutions to meet both its current and future goals while overcoming obstacles that are primed to become more complex as the population grows, ecosystems evolve and trends emerge. Through digital transformation, organizations can create one source of truth across the enterprise. Brands, programs and product lifecycles are combined into a single database that can boost collaboration across the entire CPG ecosystem while maintaining brand equity. By integrating the entire digital lifecycle, companies can improve quality, promote brand loyalty and improve speed to market for new products, enabling them to not just survive, but thrive in today’s market.

About the author

Mario Vollbracht is the Vice President of Consumer Products and Retail at Siemens Digital Industries Software. He joined Siemens in 2022 with more than 25 years of experience in the industry, including direct industry experience, management consulting and an extensive background in IT management. Vollbracht has background across the entire value chain of retail and consumer goods, with a focus on innovation, supply chain, sales, marketing and business analytics.