Report from Altair also finds a gap between adoption and expertise among automakers.

Last year, engineering.com predicted that digital twins would no longer be optional in 2023 and recommended businesses increase their exploration of the concept and its associated technology. That prediction appears accurate within the automotive industry, judging from survey results released in May by CAE software developer Altair.

Fully 76 percent of auto industry respondents said their organizations use digital twins to some degree, placing their sector second to heavy equipment (77 percent) among the 11 industry groups surveyed.

Moreover, automotive adopters claimed to be reaping substantial benefits, with 97 percent saying digital twins have helped to inform new product development and 92 percent saying they’ve helped to create more sustainable products and processes.

The survey results suggest that sustainability is an increasingly important consideration for automakers, who are pivoting from traditional internal-combustion engines toward zero-emissions vehicles. Nearly two thirds (63 percent) of automotive respondents said their organizations were purposefully using digital twins to achieve sustainability objectives; that’s eight percentage points higher than the average of all industries surveyed.

“Between consumer demand, government expectations and global emissions targets, the race is on for automakers to keep EV production on track,” said Royston Jones, Altair’s senior vice-president of automotive, in a release. “This report’s findings show the importance of digital twin technology in achieving those goals. While many have already adopted this technology into their processes, there is still tremendous room for education on the benefits that will lead to a rapid expansion of its use across the industry and beyond.”

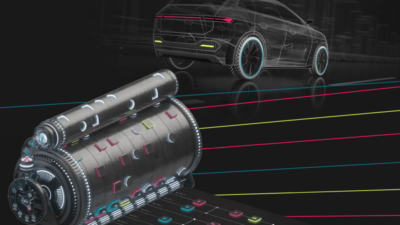

Altair defines digital twins as “the process of using data streams to create a digital representation of a real-world asset to improve collaboration, information access and decision-making.” As virtual replicas of real-world objects, processes or systems informed by real-time data, digital twins can be used for diagnostics, simulations and tests. The data provided by these assessments can be used to optimize manufacturing processes, refine maintenance scheduling and more.

Knowledge gaps could hamper digital-twin initiatives

Despite the auto industry’s high digital twin adoption rate, only 35 percent of respondents considered themselves to be “highly knowledgeable about digital twin solutions.” That was the second-lowest percentage out of the industries surveyed. This knowledge gap could be due to a lack of experience, given that 28 percentage of automotive respondents said their organizations had been using digital twins for no more than six months—the highest proportion among the industries surveyed.

The gap between the rate of digital twin adoption and the speed at which the workforce is learning how to use them could be cause for concern. Digital twins are not easy to set up and operate. Without access to sufficient knowledge, organizations are likely to see diminished returns from their digital-twin investments.

Altair’s survey touches upon another dilemma: a mismatch of the perceived value of digital twins generally and the business case for individual organizations. For instance, a 2022 survey by business consultancy Capgemini found that 55 percent of executives surveyed believed that digital twins are a strategic part of digital transformations, but 42 percent of them struggled to envision their deployment.

Among the automotive professionals in roles below senior management surveyed by Altair, 92 percent believed their organization’s leaders would be more likely to invest in digital twin technology if they better understood its benefits, including its ability to “provide an abundance of data for more efficient research,” “reduce costs of production” and “lead to better development outcomes.”

Perhaps the biggest opportunity implied by the data is for engineers themselves to seize: career advancement through digital twin expertise.

Altair’s 2023 Global Digital Twin Survey Report Vertical Breakdown: Automotive is based on a survey of more than 2,000 professionals in 10 countries. It was conducted in May 2022.